It is a sad story that our government does not have standard policies set into anything and it goes as it pleases. One day you get the message that now you have to link your PAN card with your mobile phone and next time the message says that Link the PAN with Aadharand there is no end to it. There are millions of Aadhar cards made with some or other errors in it, and problem strikes when you try to link that with your other documents.

The websites are not helping you to link them seamlessly as there are many agencies involved in it who wants to make sure that you are going to them and getting your job done. The physical presence creates chaos with the endless queue and slow working computers.

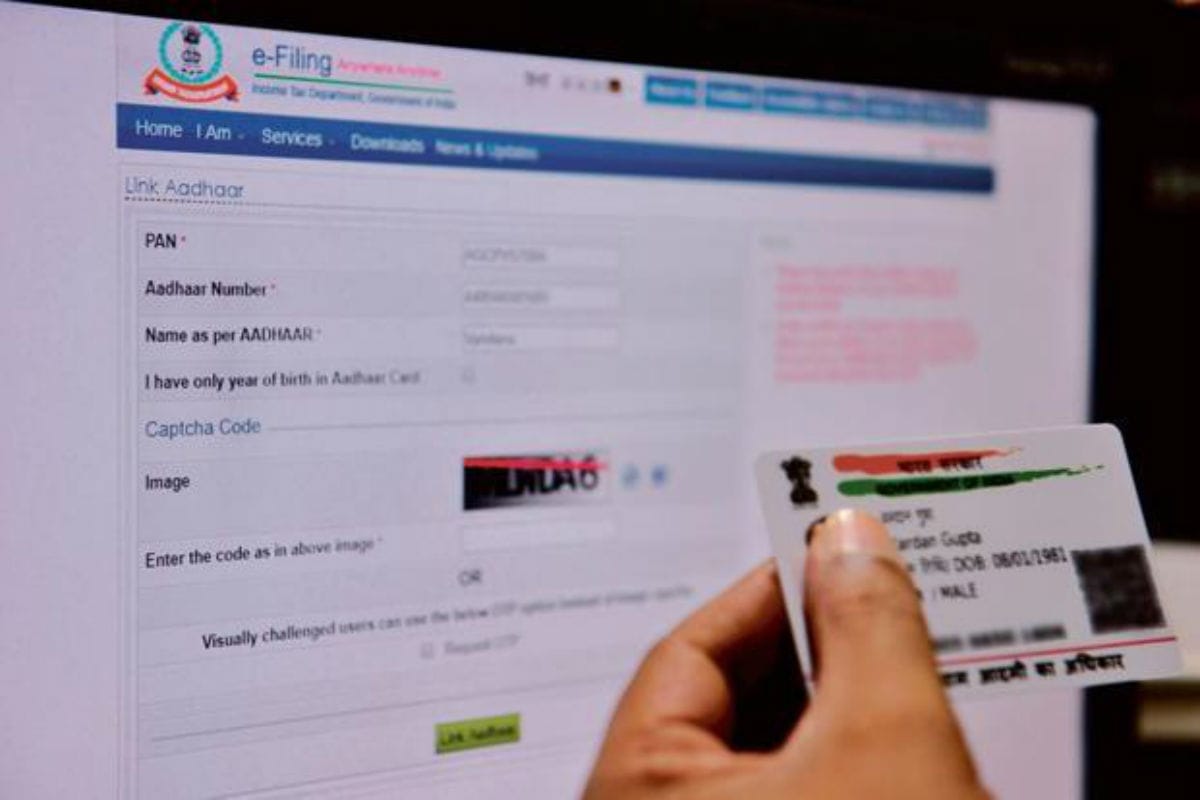

The news published in the mainstream media portals will tell you, In order to link your PAN with Aadhaar, you can visit the income tax department’s e-filing portal and click on ‘Link Aadhaar’ section. You need to enter your PAN number, Aadhaar number and name to link both. But does that really happen? No Way!

The Income-tax department earlier had set the date for linking PAN card with AADHAAR as 31st December 2019 which later on changed to March 31, 2020, why? Cause more than 17 crore PAN cardholders could not link the PAN to AADHAR and the reason is the process is complicated and does not allow you to link both seamlessly and you have to approach the private agencies for the same.

According to the reports, this is the eighth time the government had extended the deadline and despite that, over 17 crore PAN card holders are yet to link the two documents. After the amendment in the Finance Bill, 2019, the income tax department has the authority to make such PAN cards which are not linked to Aadhaar inoperative.

As per Clause 41 of Section 139AA of the Income Tax Act, “If a person fails to intimate the Aadhaar number, the permanent account number allotted to such person shall be made inoperative after the notified date in the manner as may be provided by rules.” The amendment came into effect from September 1, 2019. If PAN cardholders fail to link their PAN with Aadhaar till March 31, all such inoperative PAN cards will become useless.

Union Minister of State for Finance Anurag Singh Thakur recently told the Lok Sabha that 30.75 crore PANs were linked to Aadhaar till January. However, 17.58 crore PAN card holders are yet to abide by the guidelines. The due date to link the 10-digit alphanumeric number PAN issued by the income tax department with UIDAI’s 12-digit identification number has been extended to 31 March 2020. The extension of the due date for linking of PAN with Aadhaar will benefit these PAN holders as they will get extra time to link their PANs with Aadhaar,” Thakur said.

If you have still not linked the two documents, here’s how you can do it:

To link your PAN with Aadhaar, you can visit the income tax department’s e-filing portal and click on ‘Link Aadhaar’ section on the left. You need to enter your PAN number, Aadhaar number and name. The I-T department will validate your name, date of birth and gender against Aadhaar details after which the linking will be complete.

Source: Times NOW News